Leading the

Energy Transition

INTEGRATED REPORT 2022

At the forefront of Asia Pacific’s

renewables revolution

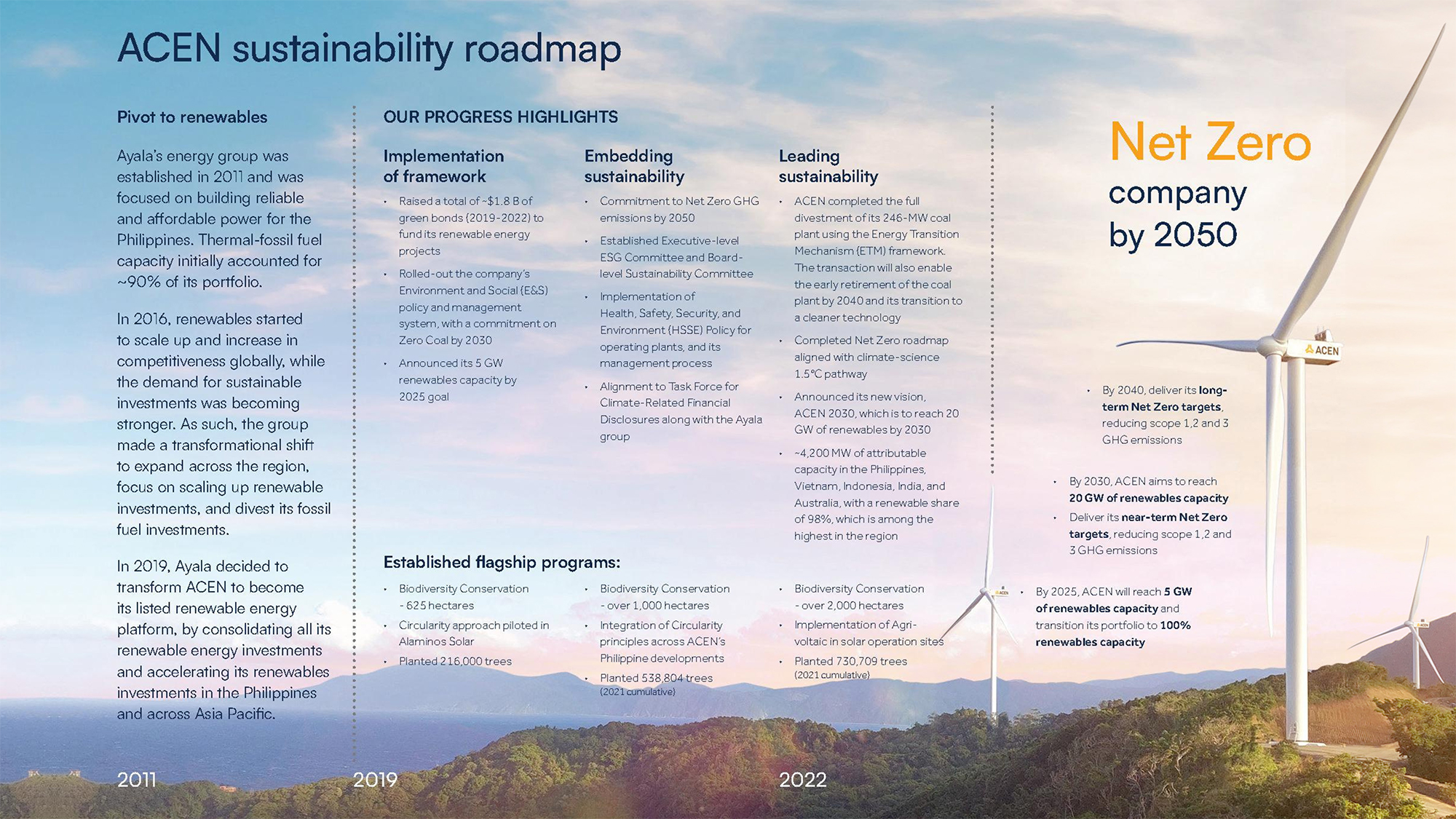

The global energy crisis has accelerated the demand for a cleaner and more secure energy ecosystem, and ACEN is taking a leading role in the renewables revolution. We are embarking on a bold strategy to turbocharge our growth by fivefold to assemble 20 GW of renewables capacity by 2030. With decarbonization at the core of our vision, our 2030 aspiration purposefully supports our goal to achieve Net Zero greenhouse gas emissions by 2050.

As a formidable renewable energy player in the Asia-Pacific with a robust growth trajectory, ACEN is well-positioned to harness the enormous opportunities and lead the global effort towards clean energy transition.

At the forefront of Asia Pacific’s renewables revolution

The global energy crisis has accelerated the demand for a cleaner and more secure energy ecosystem, and ACEN is taking a leading role in the renewables revolution. We are embarking on a bold strategy to turbocharge our growth by fivefold to assemble 20 GW of renewables capacity by 2030. With decarbonization at the core of our vision, our 2030 aspiration purposefully supports our goal to achieve Net Zero greenhouse gas emissions by 2050.

As a formidable renewable energy player in the Asia-Pacific with a robust growth trajectory, ACEN is well-positioned to harness the enormous opportunities and lead the global effort towards clean energy transition.

Business

highlights

We continued to execute our renewables expansion across our key markets, growing our renewables capacity to ~4,000 MW, which comprises 98% of total capacity, among the highest in the region.

1. Includes projects that are operating and under construction

2. Includes 48 MW from ACEN’s investment in NEFIN rooftop solar projects, across Mainland China, Taiwan, Hong Kong, Singapore, Thailand, and Malaysia.

Total Attributable Renewables Capacity

Renewable Energy Share

New renewables projects in 2022

Geographic footprint

Total assets

Market capitalization

Total shareholders’ equity

Investments in Renewables (Capex)

Target attributable renewables

capacity by 2030

Sustainable financing

Maiden peso green bond

The strong support of Philippine institutional and retail investors for our maiden peso green bond issuance will help us realize our vision 20 GW renewables by 2030.

Green loans raised for Australia expansion

Energy transition

Greenhouse gas emissions target

Net Zero by 2050

Raised from ETM transaction

Output from Renewable Sources

We showed strong growth through our attributable renewables output, which grew 27% year-on-year.

Net Income

Consolidated Revenues

Attributable EBITDA

Completion of acquisition

Australia platform

100% owned by ACEN

New strategic partnerships

ib vogt

PivotGen & UPC Solar & Wind

Puri Usaha Group

CleanTech Global Renewables

Sustainability

highlights

Attributable output from

renewable sources

Emissions avoided

gasoline-powered vehicles driven for a year1

of the asset in November 2022

Completion of

Energy Transition

Mechanism

The first market-based ETM in the world

Net Zero Roadmap

Outlines near-term scope 1, 2 and 3 GHG emissions reduction targets aligned with climate science 1.5°C pathway

Biodiversity

Nature habitat areas protected

Trees planted

The forests that we protect have become an important wildlife habitat across the region. With the help of our partners in sustainability, we create an ecologically diverse landscape thriving with biodiversity.

Read more about our environmental initiatives ›

Human capital

Employees2

Employee engagement score

Top talent retention rate

Through sustained and cohesive initiatives to integrate our values, vision and culture, our employees identify strongly with our commitment to “do better” by driving positive change for people and planet.

Community

Jobs created

Community investments

Read more on how we invest in people ›

In November 2021, ACEN established a board-level Sustainability Committee and an executive-level ESG Committee to regularly review our sustainability strategy, culture and values, while maintaining oversight of performance. An executive-level Risk and Health & Safety Committee provides oversight of operational safety and sustainability risks.

Diversity in leadership

Women in leadership positions

We empower our women and allow them to thrive towards true inclusion, recognizing their amazing contributions in the renewable energy space.

Read more about how we embed sustainability in

our business ›

Geographic

footprint

ACEN continues to expand its portfolio within its key markets, fortifying its presence with the full acquisition of the Australia platform and new solar and wind farms under construction in the Philippines, Australia, and India.

Total Attributable Capacity of

Owned Assets1

Renewable Capacity

Share of Renewables to

Total Capacity

Message from the chairman and president

We welcomed 2022 with renewed optimism as the world resumed economic activity. In the midst of the unprecedented challenges of the pandemic, we saw the opportunity to prime ourselves for a post-pandemic economic recovery. We ramped up our investments in renewable energy across our key markets as we anticipated heightened electricity demand once consumer spending resurges.

Our strategic pivot towards renewable energy over the recent years galvanizes our position as a formidable regional player

Chairman

This positive momentum was quickly challenged by geopolitical events at the beginning of the year. The war in Ukraine caused shock waves to the global energy market, triggering high fossil fuel prices and energy security issues. In addition, this exacerbated existing global supply chain challenges that led to the delay in the completion of some of our projects.

Expanding our footprint

Nonetheless, we continued to execute on our renewables expansion across our key markets in the Philippines, Australia, Vietnam, India, and Indonesia. We concluded the year with ~4,030 MW of net attributable capacity, with 98% coming from renewable technologies. The Philippines continues to be our core market, accounting for 40% of our generation portfolio, as we promptly responded to invest in new capacity amidst the tightening power supply situation brought about by resurgent electricity demand and the decline in Malampaya gas output.

Overseas, Australia is our largest market, comprising 26% of our generation portfolio. This was cemented by our acquisition of the Australia development platform, transforming the joint venture with the UPC Renewables group into ACEN Australia, our first wholly owned development and operating platform outside the Philippines. The acquisition results in ACEN’s full ownership of over 1,000 MW of ACEN Australia’s solar farms as well as its development pipeline in New South Wales, Tasmania, Victoria, and South Australia.

From challenges to opportunities

The global energy crisis has accelerated the demand for governments and businesses to adopt a green growth and sustainable development strategy, pushing renewable energy to an unprecedented level of importance. ACEN is excited to be an active participant in this historic inflection point and do our part in this shift towards a low-carbon future.

Our strategic pivot towards renewable energy in recent years galvanizes our position as a formidable regional player as the world increasingly takes urgent action to achieve a cleaner and more secure energy ecosystem. With elevated fossil fuel prices, the economics of renewable energy has become more competitive. We aim to take advantage of this encouraging momentum as we continue to scale up our renewables portfolio.

ACEN currently has around 2,400 MW of attributable generating capacity under construction, with around 1,200 MW targeted to be operational within 2023. With 700 MW located in the Philippines, we expect to progress as net sellers in the merchant electricity market as the projects become operational. This will put us in a competitive advantage under this highly volatile environment.

Our road to Net Zero

We are moving forward with our commitment to achieve Net Zero greenhouse gas emissions by 2050, which fully supports our ongoing growth and decarbonization strategy.

Our strategic pivot towards renewable energy over the recent years galvanizes our position as a formidable regional player

DELFIN LAZARO

Chairman

ACEN together with the Ayala group has engaged global climate solutions provider South Pole in the quantification of our GHG footprint and the development of a robust Net Zero roadmap. The roadmap involves the transition of ACEN’s generation portfolio to 100% renewable energy by 2025.

We have made significant progress in our roadmap. We completed the review of our scope 1 and 2 GHG reporting, screened all our 15 scope 3 emission categories, and developed a full GHG emissions inventory, including emissions from own generating assets, retail activity, and joint ventures. Further, we started the process for identifying emission reduction opportunities to form part of our strategic initiatives.

ACEN 2030 is an aggressive goal, but we believe that we have the fundamentals in place to succeed.

President and CEO

ACEN 2030 is an aggressive goal, but we believe that we have the fundamentals in place to succeed.

President and CEO

We recently completed our Net Zero roadmap, which includes near-term emission reduction targets aligned with the GHG protocol and the latest climate-science. It also includes long-term targets consistent with the deep decarbonization of the power sector. We are proud to say that ACEN is the first energy company in Southeast Asia to take this critical step towards achieving Net Zero, with an accountable and transparent framework to monitor progress.

A just energy transition

While we are strongly committed to transitioning out of coal-fired generation, we believe that this must be done in a responsible way. In an emerging market

such as the Philippines where coal plants are still inevitable until the next few decades, we must take into account the tightness in power supply and the economic relevance of thermal plants in the near to medium term. With this in mind, we implemented a Just Energy Transition by adopting the principles of the Energy Transition Mechanism, a framework promoted by the Asian Development Bank, to responsibly divest from our thermal assets and transition to cleaner technology.

We completed the full divestment of the South Luzon Thermal Energy Corporation coal plant using the ETM framework, the first of its kind in the world. This landmark transaction will enable the early retirement of the 246 MW coal plant in Batangas, Philippines.

Under the structure, the coal plant will be retired by 2040 and transitioned to a clean technology, thereby reducing its operating life of up to 50 years by half.

This will help avoid or reduce up to 50 million metric tons of carbon emissions. This mechanism, which involved debt financing from the Bank of the Philippine Islands and Rizal Commercial Banking Corporation, and equity investments from the Philippine Government Service Insurance System, The Insular Life Assurance Company, Ltd., and ETM Philippines Holdings, Inc., ensures an effective workforce evolution, community resilience, and collaboration with stakeholders. The transaction generated ₱7.2 billion in proceeds for ACEN, which will be reinvested into renewable

energy projects.

Leading green finance in the region

Being at the forefront of energy transition renders ACEN a natural participant of sustainable finance. We issued our maiden peso-denominated Green Bonds amounting to ₱10 billion with a fixed coupon interest rate of 6.0526% per annum due September 2027. The Green Bonds, which are part of ACEN’s ₱30-billion shelf registration, complies with ASEAN Green Bond Standards that requires proceeds to be used exclusively for the funding of eligible green projects. The issuance will finance around 500 MWdc of ACEN’s various solar projects in the Philippines.

Despite stepping up our funding initiatives in step with our massive expansion plan, we are able to maintain healthy leverage ratios. We ended the year with a net DE ratio of 0.19x, which provides ample capacity to fund new investments

The global energy crisis triggered an urgent need for secure, reliable, and affordable electricity supply. We saw this as an opportune time for ACEN to turbocharge its growth and help address the capacity challenges we are facing today.

In August 2022, we announced ACEN 2030, our bold aspiration to assemble 20 GW of attributable renewables capacity by 2030, representing more than a 20% compounded annual growth rate up to the end of the decade.

The global energy crisis triggered an urgent need for secure, reliable, and affordable electricity supply. We saw this as an opportune time for ACEN to turbocharge its growth and help address the capacity challenges we are facing today. In August 2022, we announced ACEN 2030, our bold aspiration to assemble 20 GW of attributable renewables capacity by 2030, representing more than a 20% compounded annual growth rate up to the end of the decade.

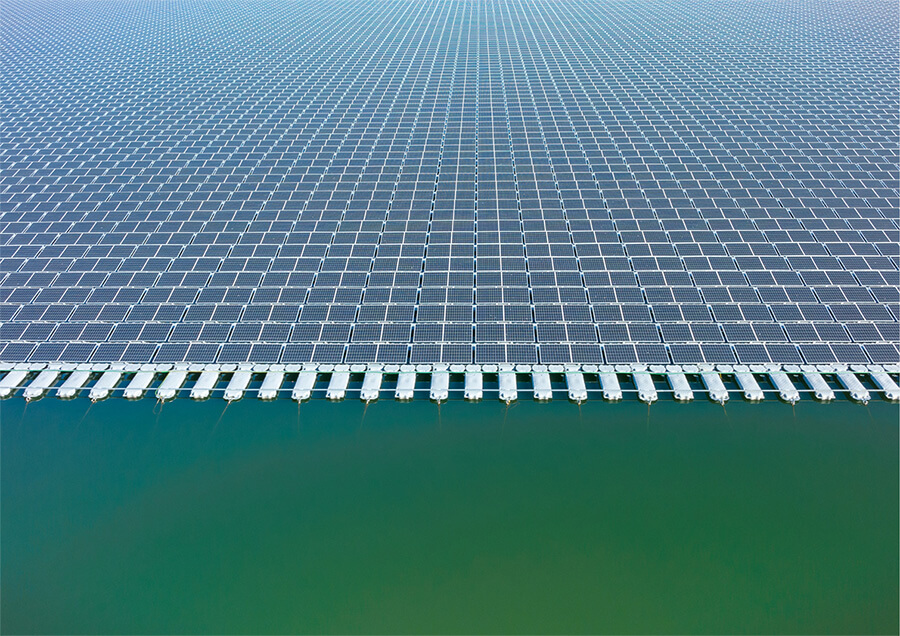

The Philippines will remain as ACEN’s core market, and we expect that Australia will remain to have the second largest footprint. In addition, we will continue to grow our presence in Vietnam, Indonesia, and India. Onshore solar and wind will remain our core energy technologies, complemented by investments in new technologies such as battery energy storage, floating solar, and offshore wind. As what we have done over the past decade, this ambitious goal will be implemented by leveraging strategic partnerships with global and regional developers, multinational energy firms, as well as local business groups, developers, and landowners. In 2022 alone, we formed new strategic partnerships, with various institutions such as ib vogt, Puri Usaha, and Pivot Power

ACEN 2030 is an aggressive goal, but with the strong commitment and support of a highly energized organization, strong balance sheet, robust pipeline of projects, and solid partnerships, we believe that we have the fundamentals in place to succeed.

Going forward, while we continue to see a challenging market domestically amid the tight power supply situation and elevated fossil fuel prices, the significant addition to our renewables operating capacity by the middle of 2023 will help augment the country’s energy supply as well as bolster ACEN’s financial performance.

Read more on our business performance ›

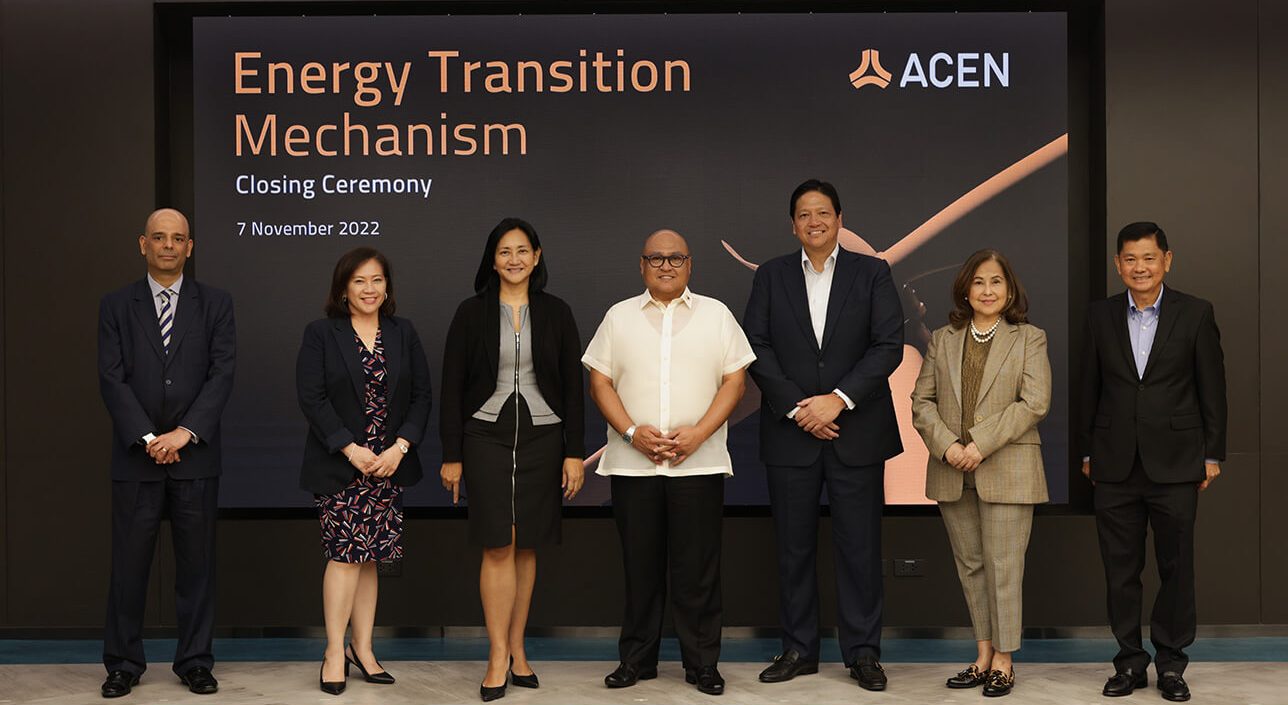

Energy

Transition

Mechanism

In November 2022, ACEN completed the first market-based Energy Transition Mechanism (ETM) transaction in the world. The landmark transaction will enable the early retirement of the 246 MW South Luzon Thermal Energy Corporation (SLTEC) coal plant in Batangas, Philippines, and will help reduce up to 50 million metric tons of carbon emissions. The coal plant’s operating life will be reduced by up to 25 years as it transitions to cleaner technology by 2040.

Read more about how we accelerate the energy transition through our ETM, and our announcement of its completion in November 2022. ›

From fossil fuels to cleaner technology

Net dependable capacity

Start of operations

April 2015

Technology

Sub-critical Circulating

Fluidized Bed (CFB)

The Asian Development Bank (ADB) promoted the ETM concept, which leverages public and private investments – from governments, multilateral banks, private sector investors, philanthropies, and long-term investors – to retire coal assets on an earlier schedule than if they remained with their current owners.

The first market-based ETM

in the world

Total transaction value

Proceeds from ETM transaction

Coal plant ownership

Zero

Following ETM transaction

CAPITAL STRUCTURE

A key enabler in accelerating the energy transition

The ACEN ETM is set to achieve its primary purpose – to accelerate the energy transition, even in the Philippines, a developing economy dependent on coal-fired power supply for baseload. With 50 million MT CO2 emissions avoided through early retirement and ₱7.2 billion raised for new renewable sources of energy, this transaction is truly a pioneering game-changer with a lasting impact on the Philippines’ carbon footprint and the shape of the country’s energy sector for decades to come.

Optimized capital structure &

cost of capital

To enable the ETM, SLTEC’s capital structure was optimized through the refinancing of its project finance loan. The debt was upsized and lengthened to optimize capitalization, and this allowed partial return of capital to ACEN. The remainder was then taken up by equity investors, which ensured a competitive cost of capital for SLTEC.

The Energy Transition Mechanism can be done, as demonstrated by our completion of the world’s first market-based ETM. While much work still needs to be done, both the public and private sectors have roles to play to collaborate and ensure a successful energy transition.

President and CEO

Key investors

Through the ETM, equity institutional

investors were able to achieve the steady returns required by their mandates through a sustainable ESG-linked investment. The banks, on the other hand, having ceased lending to new coal-fired power plants, were able to broaden their risk profile to include transitioning thermal energy facilities.

Equity

ETM Philippines

Holdings, Inc.

Debt

Energy transition loan classification has enabled banks to support the project by differentiating it from traditional coal financing.

A commitment to a just energy transition

Universal Net Zero energy

Workforce evolution

Community & resilience

Collaboration & transparency

Read more about our commitment to

Just Energy Transition ›

Value-creating business model

ACEN 2030

In August 2022, ACEN announced its vision to achieve 20 GW of attributable renewable energy capacity by 2030. We aim to realize this through geographic expansion, new technologies, and strategic partnerships, utilizing an extensive project pipeline across ACEN’s current markets – the Philippines, Australia, India, Indonesia, and Vietnam – as well as new geographies.

Know more about our corporate vision and strategy targeting 20 GW of attributable renewables capacity by 2030. ›

Catalyst for renewable energy

First-mover advantage

Turbo charging our growth

ACEN is taking advantage of this historic inflection point for renewable energy to turbocharge its growth and do our part in addressing the urgent call to move towards a low-carbon future. In August 2022, we launched ACEN 2030, a growth strategy targeting to accumulate 20 GW of attributable renewables capacity by 2030. This bold aspiration represents a sixfold expansion, with a compounded annual growth rate of more than 20% in the next eight years.

Our 3 key strategies towards

ACEN 2030

Geographic

expansion

We will cement our position as a leading renewables player in the Asia-Pacific region by utilizing our deep pipeline of projects.

New technologies

Technological advancements have improved the efficiency, reliability, and economics of renewable energy.

Strategic partnerships

ACEN’s storied history of strategic partnerships over the past decade has been key to its success.

The entire

organization is

committed to ACEN

2030, which is our

vision to reach 20GW

of renewables

by 2030.

ERIC FRANCIA

President and CEO

Geographic expansion

market opportunities and conditions

Philippines

Australia

Vietnam

India

Indonesia

New technologies

While ACEN will continue to focus on groundmounted solar and wind to achieve 20 GW, we will also make headway into new technologies to bolster our expansion. These include floating solar, offshore wind, distributed generation, and battery storage.

Strategic partnerships

While we have established development and operational capabilities, we will continue to forge new joint ventures and strategic partnerships with global and regional developers, multinational energy firms, as well as local business groups, developers, and landowners in exploring new geographies and

navigating new markets.

Leading the renewables revolution

While we recognize that our journey towards 2030 will be both exciting and challenging, we believe that with a commitment to deliver execution excellence, a team of highly energized individuals, and a robust balance sheet, we have built a strong foundation for success and take a leading role in the renewables revolution.

Watch how we are reimagining the

ACEN journey. ›

Our sustainability progress

Embedding sustainability across our strategy has established a strong foundation to the entire organization, influencing our thinking and decision making.

We’ve made important progress over the last year through our Environmental, Social, and Governance (ESG) initiatives. To make our sustainability efforts more strategic and focused, and drive the sustainability performance of our organization, we have identified key ESG issues that are material to ACEN and to what matters to our stakeholders. We have established a baseline of our ESG data, including climate that helped us develop our metrics and targets in assessing risks and opportunities.

Our ESG roadmap sets out clear targets to achieve our Net Zero greenhouse gas emissions by 2050 and sustainable development ambitions. These targets are aligned with the UN Sustainable Development Goals (SDGs). The roadmap uses metrics to track our progress toward achieving our goals.

Energy Transition Mechanism

In November 2022, ACEN completed the world’s first market-based ETM transaction that will enable the early retirement of the 246 MW SLTEC coal plant by 2040 and its transition to a cleaner technology.

Read more about our landmark ETM ›

Completion of

Net Zero roadmap

In December 2022, ACEN became the first energy company in Southeast Asia to announce a Net Zero roadmap that includes near-term scope 1, 2 and 3 greenhouse gas (GHG) emissions reduction targets, aligned with a 1.5°C pathway for the power sector.

Read more about our commitment

to Net Zero ›

Regional scale

biodiversity protection

Over ~2,100 hectares of natural habitat areas are now protected by ACEN across 20 of our developments in the Philippines, Australia, Vietnam, Indonesia, and India.

Read more about our progress on biodiversity ›

713-strong agile organization

ACEN formulated robust workplace policies and practices that strengthened the overall employee experience for its strong, agile and growing team – from our inclusive culture, learning and development opportunities, and above industry compensation and benefits.

Read more about how we put our people at the forefront ›

~19,500 jobs created and

~₱123 M invested for

communities

ACEN created tangible, long-term value for its host communities through large-scale investments for socio-economic progress, collaborating with logal governments, state agencies, conservation groups and the locals themselves, true to the company’s

commitment to nation-building.

In Ilocos Norte, the locals receive training on farming techniques to allow commercial agriculture to flourish and provide streams of livelihood for the residents.

Embedded sustainability through leadership committees

In November 2021, ACEN established a board level Sustainability Committee and executive level ESG Committee to regularly review our sustainability strategy, culture and values, while maintaining oversight of performance. An executive-level Risk and Health & Safety Committee provides oversight of operational safety and sustainability risks.

Implemented new policies to identify and mitigate risk

New policies implemented

- Health, Safety, Security & Environment

- Enterprise risk management

- Cybersecurity

Leading the

Energy Transition

INTEGRATED REPORT 2022