Our Task Force on Climate-Related Disclosures (TCFD) Report

Since 2021, we have been a supporter of the Task Force for Climate-Related Financial Disclosures (TCFD), established by the Financial Stability Board to develop voluntary, consistent, climate-related financial disclosures to improve transparency on climate risks and opportunities. These disclosures revolve around four thematic areas: governance, strategy, risk management, and metrics and targets.

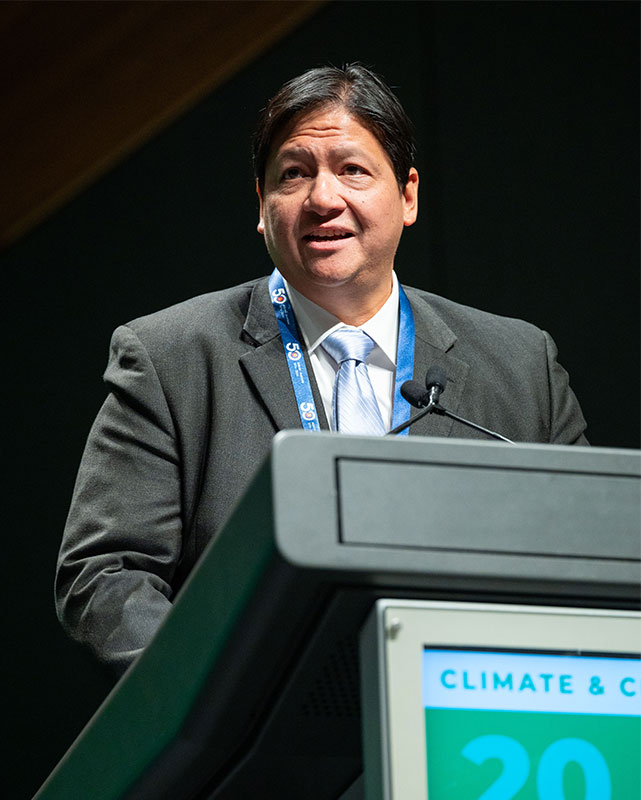

Our CEO Eric Francia delivered a keynote address during a Climate and Clean Energy Transition forum at the 2024 ASEAN-Australia Special Summit in Melbourne.

Governance

Board oversight on climate governance

The Board plays an integral role in our climate agenda, including the increasing integration of climate-related issues into our broader corporate strategy. In particular, the Board reviews and approves major strategic decisions proposed by senior management around energy transition, decarbonization strategy, portfolio of top risks including climate and medium and long-term climate targets. Further, the Board reviews and approves management’s specific responsibilities against ESG targets, including the development of science-based metrics and targets towards our Net Zero goal by 2050.

In recent years, key strategic decisions of the Board have had an increased focus on climate change. These include the establishment of our Environmental, Social and Governance (ESG) Policy which defines our transition to a low carbon portfolio and our commitment to Net Zero by 2050 as announced in 2021. The Board was likewise instrumental to the divestment and early retirement of the 246 MW SLTEC coal plant and its transition to cleaner technology by 2040 through the landmark Energy Transition Mechanism.

To sharpen our focus on our sustainability agenda, in 2021, the Board created the Sustainability Committee to review strategic objectives and monitor the progress of sustainability initiatives, including climate change and lead all climate-related matters.

Since its inception, the Sustainability Committee has provided oversight on our key climate initiatives: the Net Zero commitment, transition to a low carbon portfolio and carbon emission reduction targets.

Additionally, the Board’s Risk Management and Related Party Transaction Committee has oversight of our enterprise Risk Management system, which includes climate risks.

Management oversight on climate governance

Management is primarily responsible for the execution of Board-approved climate-related strategies and monitoring of performance.

In addition, it designs and implements an adequate and effective system of internal controls and risk management processes to ensure the achievement of objectives while maintaining compliance with laws, rules

and regulations.

To facilitate the flow of strategic and operational information among key decision-makers, we created in 2022 the ESG Committee at the executive level to review, monitor and aid senior management and the Board on policymaking and decision-making processes around ESG issues.

Our risk and insurance management team regularly conducts risk engineering surveys and roadshows in the ACEN headquarters and plants.

The Committee is composed of the functional heads of governance and compliance, sustainability, investor relations, and headed

by the chief risk, human resources and administrative officer. In addition, we created the Risk and Health and Safety Committee to provide oversight on operational safety and sustainability risks.

At the corporate level, the sustainability

team has oversight in managing sustainability initiatives, climate-related risks and opportunities, as well as climate-related disclosures. At the project level, development leads proactively mitigate the physical effects of climate change in the planning and design of new projects. The sustainability team works closely with the development teams to ensure that any environmental and climate-related issues are adequately addressed. For operating plants, plant managers as well as health, safety, security and environment teams work closely with the sustainability team to address any environmental issues and manage the physical risks of climate change.

Strategy

Our long-term strategy is tied to climate action, enabling us to play a leading role in the energy sector’s transformation towards a low-carbon economy. Since 2023, sustainability has been part of our corporate key result areas which are regularly monitored and reported to the Board of Directors.

In 2022, we engaged Aon and The Climate Service (TCS) to conduct a climate scenario analysis, quantifying the impact of climate-related risks to the company’s 40 existing sites. We used Representative Concentration Pathways (RCPs) 4.5 and 8.5 scenarios to model the financial impacts until 2030. The RCP 4.5 Low Emissions scenario implies coordinated action to limit greenhouse gas emissions to achieve a global temperature warming limit of approximately 2 °C, while the RCP 8.5 High Emissions scenario assumes that no major global effort to limit greenhouse gas emissions will go into effect. In this scenario, it is estimated that end-of-century increases in global mean surface temperature will be in the range of 4.2 to 5.4 °C. For both the analyses for climate-related physical risks and climate-related transition risks, the Modelled Average Annual Loss (MAAL) was used to determine the possible loss after considering the investments made on existing risk mitigation measures.

Recognizing that our asset portfolio continues to grow and that climate models improve over time, we will conduct another climate-related scenario analysis starting 2025, in line with our three-year cycle for climate risk assessment. We plan to improve our climate analytics, covering both physical and transition risks until 2050.

Climate-related physical risks

Based on the scenario analyses, extreme temperature was the most significant physical risk. To address this, we adjust work schedules and monitor heat indices to safeguard workers during extreme heat. We also continue to improve our emergency response plans for various climate hazards.

As global temperatures affect wind patterns and heat indices, our renewable energy projects may experience revenue reduction and property damages. We continue to look into modeling these extreme temperature scenarios and how to best mitigate against these, focusing on integrating climate-resilient measures in our projects.

Flooding is also a major risk as some wind farms are built in coastal areas. To mitigate the risk of flooding, key equipment is placed in higher or raised areas while the rest of the power generation assets are built to become more flood-resilient. To reduce wildfire occurrence, our projects install fire breaks and regularly manage vegetation.

Climate-related transition risks

Due to the changes in wind patterns, heat indices and the global supply chain brought about by climate change, there is an expected loss of value as organizations align with the shifting policies, technologies, markets and consumer preferences towards a low-carbon economy. This risk is expected to be gradual, affecting our business model more than the physical assets themselves.

To address transition risk, we are committed to becoming a Net Zero company by 2050, with near-term emission reduction targets aligned with the GHG Protocol and the latest climate-science and long-term targets that are consistent with the deep decarbonization of the power sector. We are also leading efforts on energy transition, having completed the first market-based Energy Transition Mechanism (ETM) and pioneering

initiatives on Transition Credits.

Our growing asset in the Philippines, which includes the 60 MW Pangasinan Solar, entails continuous enhancement of our climate models over time.

Risk management

Climate-related risks are considered in our Enterprise Risk Management process, with climate-related physical and transition risks

as part of our risk universe and risk dictionary. Identifying climate-related risks is embedded in our project development and operational cycles.

Natural catastrophe analysis

Part of our project development process is an assessment of the risks around topography, weather patterns, hydrological studies, seismological studies, volcanic activities and water levels. These assessments inform mitigation measures that are implemented across the construction and operation phases. For operating assets, we regularly review the risk of natural catastrophes to our projects sites, leveraging available tools such as the NATHAN tool from Swiss Re, a leading global insurance provider. See an example of a natural catastrophe report using the abovementioned tool.

Metrics and targets

Greenhouse gas emissions

Having established our near-term and long-term greenhouse gas (GHG) emissions reduction targets as part of our Net Zero roadmap, we have monitored our progress in 2024 covering scope 1, 2 and 3 GHG emissions.

Across this report, we have disclosed metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

Read more about our Net Zero roadmap.

Proactive maintenance is a key component of our risk management strategy, allowing us to safeguard our clean energy infrastructure against extreme weather conditions and continue delivering sustainable power for the long term.