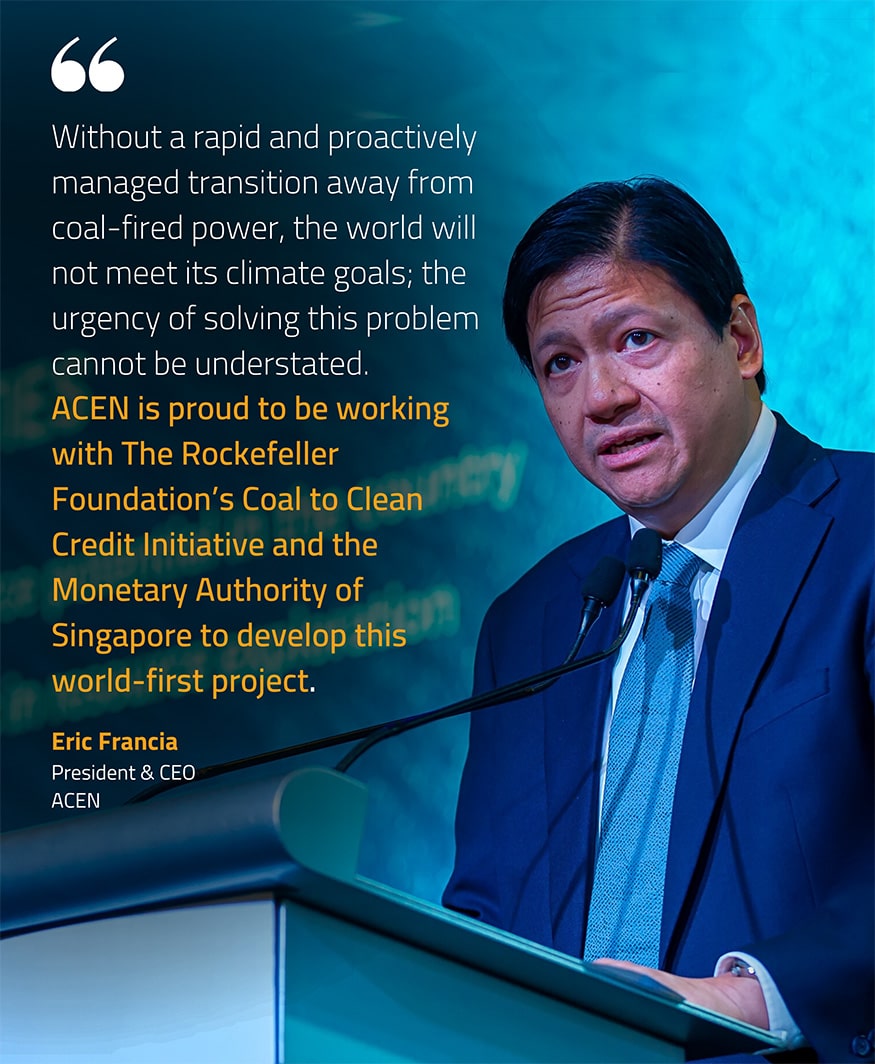

December 2023 – At COP28, ACEN announced its partnership with The Rockefeller Foundation’s Coal to Clean Credit Initiative (CCCI) and the Monetary Authority of Singapore (MAS) to explore major step towards accelerating the phase-out of coal plants in line with the Paris Agreement.

As a leader in energy transition, ACEN is looking to further accelerate the transition of SLTEC coal plant to clean technology as early as 2030, and replace the foregone generation with clean, reliable, and affordable energy. The replacement energy is likely to come in the form of Integrated Renewables and Energy Energy Storage System (IRESS) such as a combination of wind and solar power plant integrated with battery storage.

Transition credits will be an important mechanism to help ensure a just transition, ensuring affordability of the replacement energy as well as the just transition of the local community and the affected workers.

Transition Credits

The pioneering initiative between ACEN, CCCI and MAS seeks to develop the world’s first Transition Credit (coal-to-clean pilot project) that would leverage carbon finance to phase out a coal-fired power plant and replace it with renewable energy. This first of-its-kind project would mark a major step towards phasing out coal in line with the Paris Agreement.

Our partners

Rockefeller Foundation

The Rockefeller Foundation is a pioneering philanthropy built on collaborative partnerships at the frontiers of science, technology, and innovation that enable individuals, families, and communities to flourish. We make big bets to promote the well-being of humanity. Today, we are focused on advancing human opportunity and reversing the climate crisis by transforming systems in food, health, energy, and finance.

Coal to Clean Credit Initiative (CCCI)

The Coal to Clean Credit Initiative (CCCI) is a consortium of global experts, led by The Rockefeller Foundation and supported by the Climate Policy Initiative and South Pole. RMI (founded as Rocky Mountain Institute) provided technical support for the creation of the draft methodology. The consortium is focused on ensuring that CCCI’s methodology is established according to the highest level of environmental integrity, technical best-practice, and credible, cross-societal stakeholder engagement.

Monetary Authority of Singapore (MAS)

The Monetary Authority of Singapore (MAS) is Singapore’s central bank and integrated financial regulator. As a central bank, MAS promotes sustained, non-inflationary economic growth through the conduct of monetary policy and close macroeconomic surveillance and analysis. As an integrated financial supervisor, MAS fosters a sound financial services sector through its prudential oversight of all financial institutions in Singapore and financial market infrastructures. It is responsible for well-functioning financial markets, sound conduct, and investor education. MAS also works with the financial industry to promote Singapore as a dynamic international financial centre.