Our commitment to ESG

drives meaningful impact

for all our stakeholders

2.90 PHP

PSE:ACEN as of 14 April 2025; 3:00pm

+0.06 |

+2.11% |

2.84 |

2.84 |

Reports

Presentations

Key messages from the

2024 Annual Stockholders’

Meeting

Delfin Lazaro

Chairman (outgoing)

Eric Francia

President and CEO

Business highlights

from 2023 Integrated Report

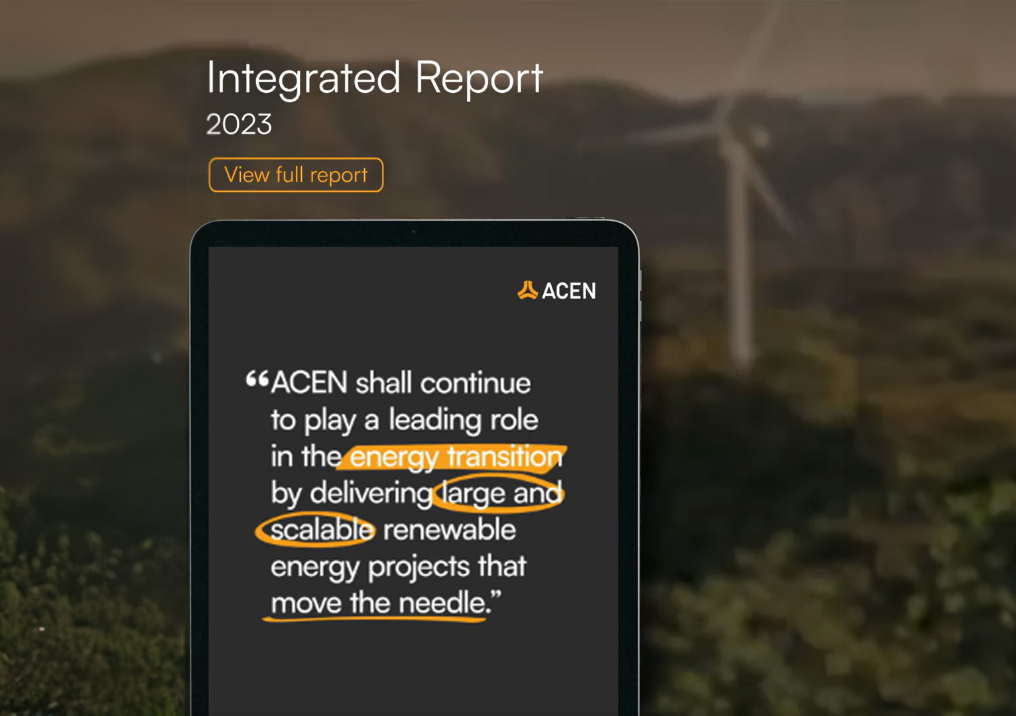

“We have made significant progress with the continued ramp-up of our projects, helping provide much needed supply to the Philippines and across the region as we effectively reach our 5 GW target ahead of schedule.”

ERIC FRANCIA

President & CEO

Investments in renewables (Capex)

₱55 B

Sustainable financing Green loans for Australia expansion

AU$352 M

Financing initiatives with ADB

US$107 M

Financing package for the 88 MW Ninh Thuan Wind in Vietnam

₱11 B

Sustainability-linked loan facility for the development of solar projects

₱25 B

The first perpetual preferred share issuance on the Philippine Stock Exchange

Preferred equity

₱25 B

Renewable Energy

5 GW

We have effectively achieved our goal of reaching 5 GW of renewables capacity by 2025, approximately two years ahead of plan.

Renewables Growth

We embarked on a bold strategy to turbo charge our growth and assemble 20 GW of renewables capacity by 2030

Total asset value

₱284.9 B

Market capitalization

~₱174 B

Total shareholders’ equity

₱173.4 B

Attributable output from renewable source

4,500 GWh

32% increase

Net income

₱7.4 B

Consolidated revenues

₱36.5 B

Attributable EBITDA

₱18.8 B

Retail electricity supply (RES) growth

218 MW

54% increase in commercial and industrial customers

In focus

ACEN: Green Finance Leadership

ACEN is the largest issuer of green bonds in the Philippines with over $1B green bonds raised.

Maiden Peso-denominated Preferred Shares

ACEN marked the issuance of its ₱25.0 billion perpetual preferred shares, listed on the PSE on September 2023.